Why Original Research Matters More Than Ever in the GEO Era

If you’re leading marketing or communications at a B2B tech company, your team is almost certainly producing more content this year than last (thanks largely to AI). Although budgets have barely budged, content volume is up sharply, with nearly half of B2B marketing leaders saying their teams' content output has roughly tripled.

Yet, you're likely seeing less engagement and fewer conversions. Part of the problem is the flood of low‑quality AI‑generated content. For example, an Ahrefs analysis of 900,000 newly published web pages found that 74% contained AI-generated content; only 26% of the pages were classified as purely human-written.

And, that's just web copy. When you consider blog posts, long-form content, social posts and other content your team produces, it's no surprise that 54% of your peers say it's difficult for their teams to differentiate marketing content.

Here's the real issue: everyone is producing more content. You and your competitors are writing about the same topics and targeting the same keywords. Since AI tools draw from the same training data and default to the same patterns, the majority of the output sounds the same.

In today's world of "AI slop," the only content that reliably differentiates your brand is content anchored in something AI and your competitors can’t copy: original research and proprietary data.

Original research sets you apart, but most teams only scratch the surface of what their data can do. Read: "One Survey, Many Stories: The Content Engine B2B Tech CMOs Need" for the five mistakes that keep B2B research programs from delivering real results.

Recent research with nearly 2,000 B2B decision‑makers shows that high‑quality, insight‑driven thought leadership is more effective than traditional marketing at demonstrating a vendor’s value, and that it’s often what turns hidden stakeholders into active champions.

-

71% of hidden decision-makers say high-quality thought leadership is more effective than conventional marketing or sales materials at demonstrating a vendor’s value.

-

64% say they trust thought leadership more than product sheets when assessing capabilities.

-

95% of these hidden buyers say strong thought leadership makes them more receptive to sales and marketing outreach.

Why original research does what AI‑generated content can’t

AI can remix what already exists, but it cannot generate new facts about your market. That distinction matters more every month. In one audit of nearly 2 million sessions and 7,500 ChatGPT referrals, 52% of cited blog posts featured original data. Follow‑on studies show ChatGPT is 2-3X more likely than Google to cite pages that use tables and structured data.

AI gives disproportionate weight to stories built on original research and proprietary data.

Similarly, Muck Rack’s, “What Is AI Reading?” study, which analyzed more than 1 million links cited by AI tools, found:

-

95% of AI citations come from non-paid media

-

89% come from earned media

-

49% of citations for recent queries originate from journalistic content

According to Muck Rack’s study, AI systems frequently surface industry‑specific trade and vertical outlets when answering category questions. That makes earned coverage in the right niche publications more critical than ever, especially when those stories report fresh statistics and proprietary findings that AI can reliably cite.

If AI doesn’t mention your company, that's a problem

Your buyers are no longer just “Googling and clicking.” A growing body of data shows they are bypassing traditional search entirely and going straight to AI tools for vendor discovery and shortlisting. In fact, 95% of B2B buyers now plan to use generative AI in at least one area of a future purchase. More than half say it has already led them to consider more or different vendors while saving them time in their purchase process.

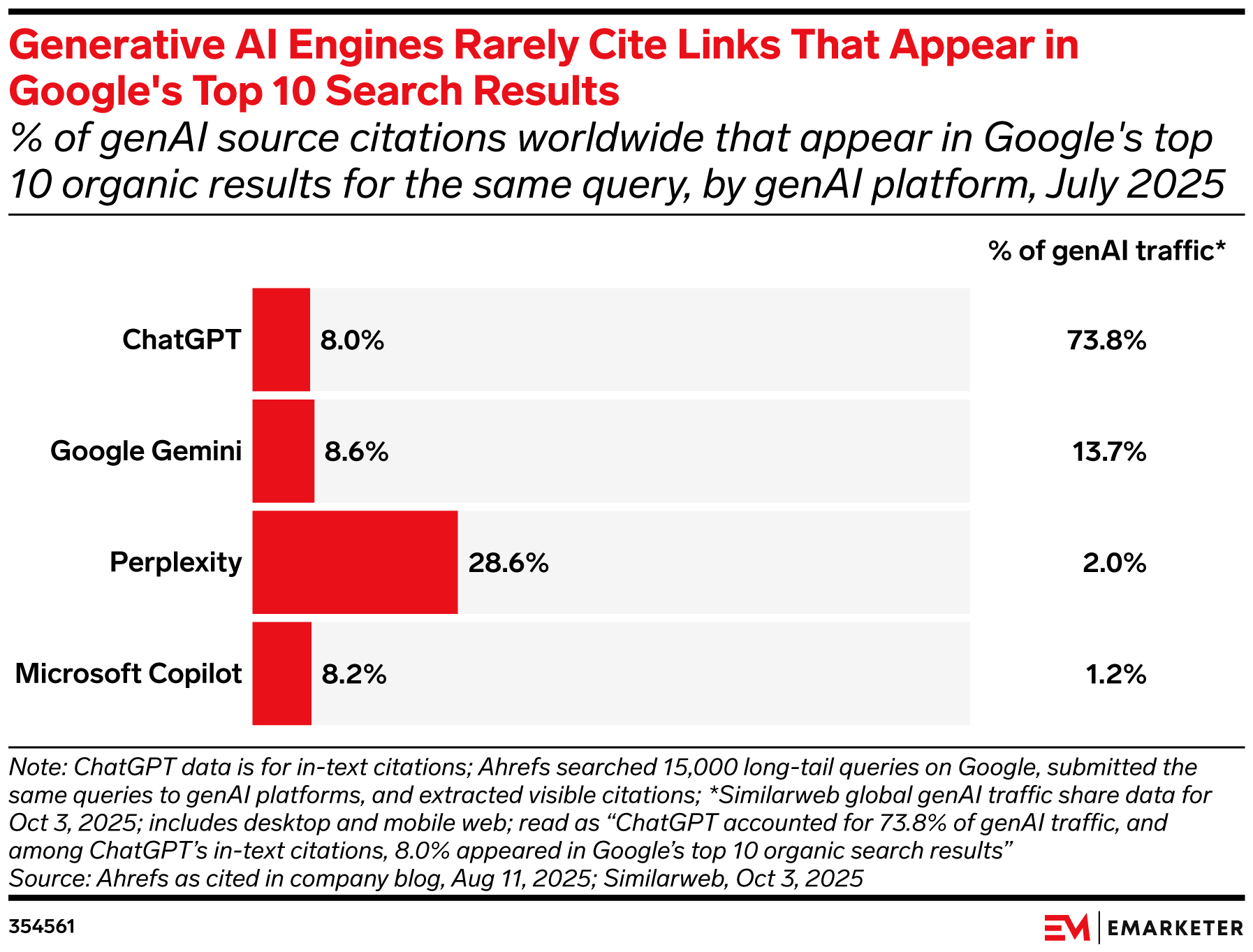

The problem is that your hard‑won SEO doesn’t carry over. You need to manage generative engine optimization (GEO) separately. Here's why: fewer than 10% of the sources cited by major AI systems (ChatGPT, Gemini, Copilot) ranked in the top 10 Google results for the same query.

The net is, you can be number one on Google and still be invisible when a buyer asks AI, “Who are the leading vendors in X?”

With GEO, the buyer sees a synthesized answer with a handful of citations. Your company is either one of those cited sources, or it's not in the consideration set.

If, however, you create original data and publish it in ways AI can reliably cite (both on your own site and through media coverage), you dramatically increase your odds of showing up on those GEO-sourced vendor lists.

Don’t treat research like a one‑and‑done campaign

Many B2B tech marketing and PR teams commission a survey, publish one flagship report, run a campaign promoting that report, and then move on.

That model made sense when success meant a few weeks of coverage and a gated PDF that generated MQLs. It breaks down when AI research tools, trade media and hidden buyers are all rewarding brands that show up with new, credible data quarter after quarter.

One well-designed original research survey should support multiple reports that you release over 12 to 18 months. Instead of a single spike of attention, you create a sequence of data drops that keep your research (and your brand) visible in the media, online, in social channels and inside AI search experiences.

One well-executed original research survey fueled 400+ pieces of content, 14 thought leadership articles and 200+ media mentions for a single B2B tech client. Read: "Consumer Surveys Yield B2B Selling Points" to see how it worked.

This is also where your agency model either amplifies or dilutes your impact. When research design, narrative development, content production and media strategy live inside a single, integrated full‑service agency, every data point works harder across channels. With a fragmented multi‑agency setup, you often lose consistency, speed and shared learning between teams.

Most original research underperforms, unfortunately. Read this companion blog post for a practical walkthrough of the six checkpoints that determine whether your original research program becomes an 18‑month content engine or a one‑off campaign.

If you'd like to talk through how to build an original research program that delivers for the next 12 to 18 months, I'd welcome the conversation. You can grab time on my calendar here.